Table of Contents

The need to carry bulky wallets and look for change is fading in this digital world. The arrival of mobile payment is making our transactions faster and more convenient. These apps, like Apple Pay, Google Pay, and Samsung Pay are some of the most essential apps in the market. They are better for shopping online, paying at coffee shops, and splitting money with friends and family.

This article you are going to read will help you discover the 10 benefits of mobile payment. A person who uses mobile payment online can get better security, exciting cashback rewards, and more. After reading this blog, you can also understand why millions worldwide are switching to digital wallet apps.

This article also provides other data, such as the countries using more digital payments and their mobile payment apps. Using apps like Phone Pe can save time, protect money, and help you manage your budget smarter!

What Is Mobile Payment?

Mobile payment means any financial transaction done by using a mobile device like a smartphone or tablet. This method is beneficial because it does not use cash or physical cards. Instead of using physical things, it uses many types of mobile payment apps like Google Pay, Apple Pay, Samsung Pay, and PayPal.

You may see different types of mobile payment in the world, including:

- Near Field Communication (NFC) payments – In this method, you can tap-and-go transactions using Google Pay Download or a related app.

- QR code payments – Here, the user can scan a code to pay instantly via digital wallet apps.

- In-app payments – This is a method where users can purchase goods or services directly within an app.

- Online mobile payments – This is a method where a customer uses e-commerce websites to buy products, which leads to a mobile payment app to complete transactions.

The use of contactless technology is improving in every sector. Mobile online payment is a preferable method due to its speed, security, and rewards.

After understanding the concept, let’s see the statistics and trends of mobile payment in the world.

Global Mobile Payment Growth Statistics And Trends

The use of mobile payment first started in Finland and second inJapan and later, it spread worldwide. From that moment onwards, the use of this transition is increasing. With the arrival of more smartphone users, people started using mobile payment more. Let’s see some of the key statistics:

- Global Market Size: The mobile payment market estimation was approximately USD 88.50 billion in 2024 and is expected to increase by 38.0% from 2025 to 2030.

- User Spending in the U.S.: Each mobile payment app user in the United States spent an average of USD 3,693 in 2024. This is an 87.0% increase compared to 2020 spending data.

- Transaction Volume in India: India’s Unified Payments Interface (UPI) is a revolution in the country. People used Google Pay, PhonePe, and Paytm for their transactions and reached more than 10 billion per month in 2023.

- Consumer Preferences: Approximately 52% of world mobile payment app consumers worldwide prefer contactless payments for safety and convenience.

- Millennial Engagement: 70% of millennials use digital wallet apps because of cashback offers, rewards, and ease of use.

- E-commerce Integration: Since the mobile app was integrated into e-commerce, 60.2% of all online purchases were made via mobile payment apps between April and August 2022.

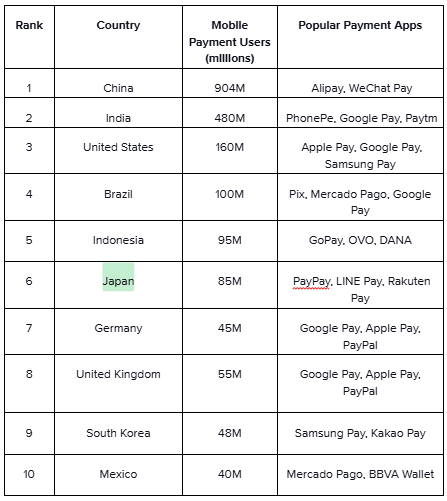

Top 10 Countries Leading In Digital Payment

This data will show you the top 10 digital payment users with their numbers, mobile app downloads, and usage.

Essential read: 15 Fintech Companies In India You Should Know About Right Now

Now, it’s time for us to take a look at the 10 advantages of using mobile apps payment methods.

10 Advantages Of Online Payment

People around the world use digital mobile payments for many reasons. Some people use it for security reasons while others use it for convenience. Below are the 10 benefits of mobile payments with their details.

1. Convenience

The need to carry big wallets is not coming back again in this digital world. With a mobile payment app and a smartphone, users can pay for everything with ease.

- No need for physical cash or cards – The mobile app is simple, and you can tap and pay for the services.

- Easy setup – Using these apps does not need a degree from Harward. Just download Google Pay or PhonePe, link your bank account, and pay instantly.

- Accepted everywhere – In countries like India and China, this method works from local stores to online shopping sites.

2. Faster For A Busy Lifestyle

Have you ever been stuck behind someone counting cash at checkout? There is no need to worry now with mobile payments because they are faster in use.

- Tap-and-go technology allows you to give the payment on the spot.

- If you know how to use this app, you don’t need to enter long card details or wait for OTPs.

- Google Pay App and Samsung Pay let you pay in seconds after scanning the QR codes.

3. Security Features

If you are asking yourself, “Is mobile payment safe?” Absolutely! It is safer than carrying a physical card or cash.

- Biometric authentication – Each time you use an app for payments, it uses your fingerprint or face ID for extra security.

- Tokenization technology – Your real card details or PIN are not shared with other people, which reduces fraud risks.

- Encryption- Apps like Google Pay App Store & WeChat Pay encrypt all your transactions.

4. Global Accessibility And Cross-Border Payments

Do you travel often? Mobile payments are better because they allow you to less depend on currency exchange hassles!

- Use Google Pay Download or PhonePe to pay in multiple countries.

- These apps are Ideal for tourists, freelancers, and businesses handling international transactions.

- Some apps like Google Pay are accepted in several countries. It helps you be less dependent on particular countries’ currencies.

5. Multiple Payment Options In One Place

A mobile payment app is more than cash because it is a one-stop payment solution for many.

- QR code payments – Scan & pay instantly.

- NFC (Near Field Communication) – Tap your phone instead of swiping a card.

- In-app purchases – A user can pay directly within apps without entering payment details.

6. Easy Online Shopping Experience

Are you aware that 60% of e-commerce transactions are made via mobile payments? That’s the use of this technology.

- No need to enter card details each time—just open the Google Pay App or Apple Pay and proceed with the payment.

- Online payment is faster and easier, so there is less chance of abandoned carts for businesses.

- It works easily with apps like Amazon, Flipkart, and other online stores.

7. Cashback, Rewards And Exclusive Offers

Why do people love this payment method? Not just for speed or convenience but for reward for spending.

- Cashback on transactions – Users get money back on purchases.

- Discounts & promo codes – Online payment helps you save big while you shop.

- Loyalty rewards – It helps you earn points every time you pay through a digital wallet app.

8. Reduce The Risk Of Theft And Fraud

Losing your wallet is bad because you don’t get back the money and details. When you use mobile apps, you can take all the details back with another device, and there is less of a chance of losing your money from your account.

- No physical cash means only less chance of risk of theft.

- Remote lock features your mobile or blocking account, which is helpful for mobile payments.

- Using apps for payment also comes with options like AI-powered fraud detection to keep your money safe.

9. Eco-Friendly And Paperless Transactions

Switching to cashless payments is useful for the environment.

- No more printed papers or receipts because transactions are recorded digitally.

- Digital transactions reduce paper usage and lead to a greener planet.

- By encouraging a cashless economy, you can reduce the need for paper money.

10. Future-ready With Smart Integrations

When people use more digital payments, companies can use AI and voice assistants to revolutionize payments.

- Voice payments – With Siri or Google Assistant, a customer can pay their bills.

- Smartwatch & IoT integrations – This method helps you pay with a tap on your wrist!

- Essential in cities- Mobile payment online solutions are essential in smart cities for faster and more secure payments.

A Final Thought

The use of mobile payment systems is making payment easier and convenient. This payment method is convenient, and faster, and mitigates the risk of fraudulent activities compared to the traditional method.

With this option, the need to visit stores for purchases is decreasing, and people prefer the e-commerce method for convenience. Even though it is beneficial, it is vulnerable to online fraud activities.

The companies are working hard to make the mobile payment online system more secure with technologies like blockchain. The fact is that people are comfortable and happy with the use of technologies like mobile payment.

FAQs

1. What are mobile payments?

Mobile payments is a method of payment used by smartphones or tablets. It helps a customer to pay for goods and services without using cash or physical credit/debit cards. Examples are Apple Pay, Google Pay, and Samsung Pay.

2. How secure are mobile payment methods?

Mobile payment systems are secure compared to cash and cards. Service providers like Alipay and Samsung Pay use advanced security measures such as encryption, tokenization, and biometric authentication to protect their financial information.

3. What are the benefits of using mobile payments?

This type of payment system is convenient, faster, and secure for the users. There are other advantages like global accessibility, multi-payment options, and user rewards and benefits.